Living in Suffield, CT: Why It's Great

Nestled along the Connecticut River, Suffield, CT is one of those rare towns that blends small-town charm with easy access to big-city conveniences. If you’re searching for a place where neighbors wave hello, local businesses know your name, and nature is just outside your door, Suffield might just

Read MoreTips for Buying a Home in Connecticut This Fall

There’s something special about Connecticut in the fall—the turning leaves, the crisp air, and the cozy neighborhoods that seem to glow with seasonal charm. If you’re thinking about buying a home this autumn, you’re in luck! Fall can offer unique advantages for homebuyers, especially in the Nutmeg S

Read MoreNow is the time to sell your Granby home!

Are you considering selling your home in Granby, CT? Now is the perfect time to make that move. The real estate market is thriving, and demand for homes in our charming town is at an all-time high. Whether you’re looking to downsize, upgrade, or relocate, taking advantage of the current market condi

Read MoreWhat You Really Need To Know About Home Price Headlines

According to recent data from Fannie Mae, almost 1 in 4 people still think home prices are going to come down. If you’re one of the people worried about that, here’s what you need to know.A lot of that fear is probably coming from what you’re hearing in the media or reading online. But here’s the th

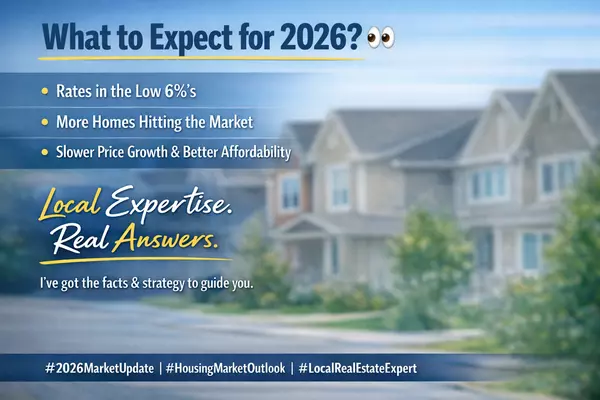

Read MoreWhat’s the Latest with Mortgage Rates?

Recent headlines may leave you wondering what’s next for mortgage rates. Maybe you’d previously heard there were going to be cuts this year that would bring rates down. That refers to the Federal Reserve (the Fed) and what they do to their Fed Funds Rate. While cutting, or lowering, the Fed Funds Ra

Read More-

Categories

Recent Posts